The 5-Rep Root Cause™

Don't Just Treat the Symptom. Train the Source.

Most financial plans fail because they stop at the surface. It’s time to dig deeper with the 5-Rep Root Cause™ method.

Why One Rep Isn't Enough

You wouldn't walk into a gym, lift a dumbbell one time, set it down, and expect to see muscle growth. You know that real strength requires repetition. It requires pushing past the initial resistance to get to the muscle failure that stimulates growth.

Yet, this is exactly how most people treat their money.

When a financial mistake happens—like blowing the budget or missing a savings goal—most people ask "Why?" just once.

"Why did I overspend?"

"Because I didn't stick to the budget."

That is One Rep. It is technically true, but it is too weak to build new muscle. If you stop there, you are only treating the symptom. The behavior will inevitably return because the source is still active.

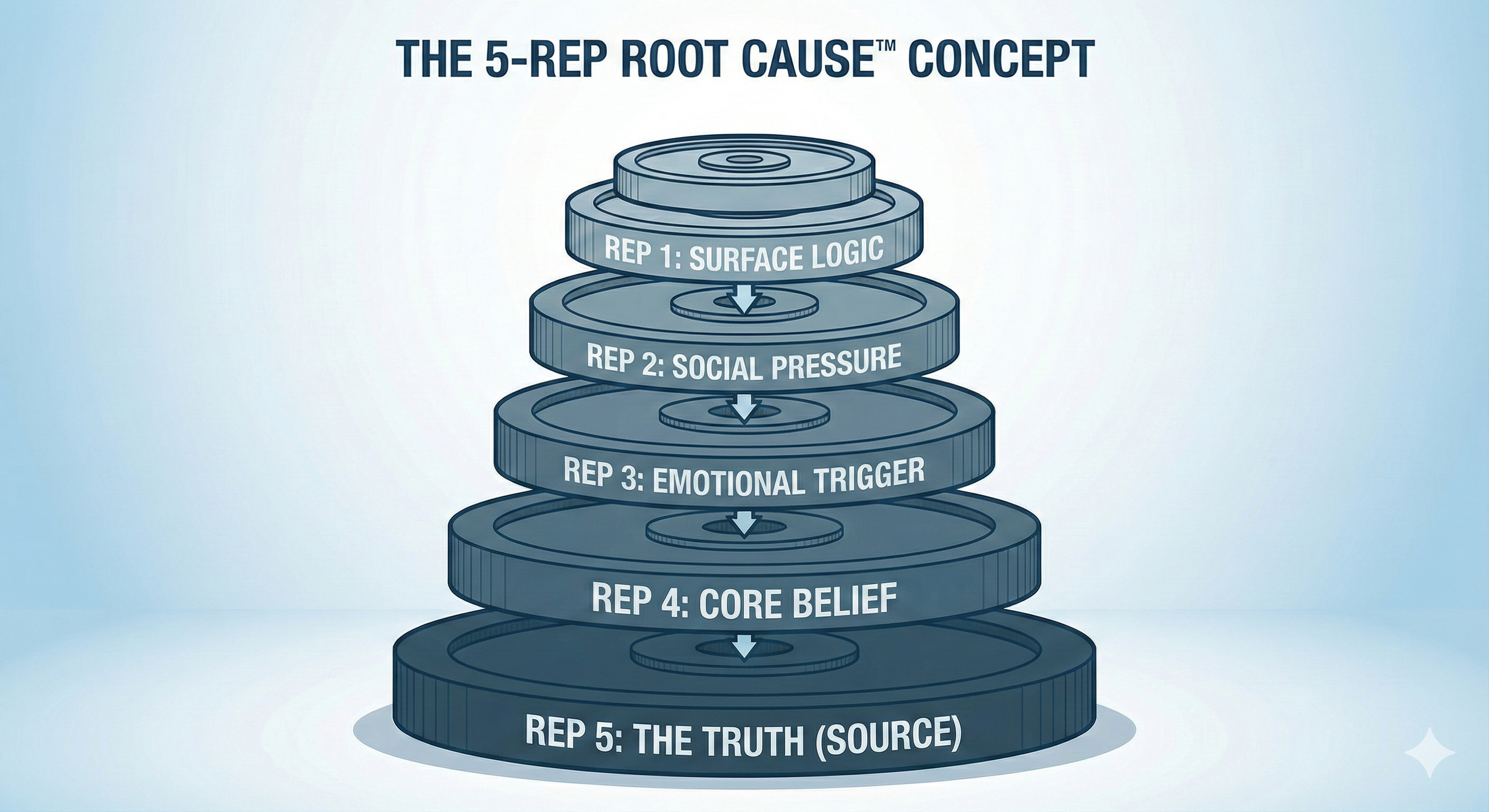

The 5-Rep Root Cause™

To build Financial Fitness, we have to go heavy. We have to do the full set.

The 5-Rep Root Cause™ is a behavioral drilling technique designed to bypass your logical defenses and emotional excuses to find the actual driver of your financial decisions.

We peel back the layers five times.

Reps 1 & 2 usually reveal the logistical excuses.

Reps 3 & 4 expose the emotional triggers.

Rep 5 reveals the Core Belief.

Once we identify the Core Belief, we aren't just budgeting anymore. We are reprogramming.

The Method in Action

Here is what a set of the 5-Rep Root Cause™ looks like in a real coaching session.

The Symptom: "I spent $500 on a dinner I couldn't afford."

Rep 1: Why did you do that?

Response: "Because it was my friend's birthday and I wanted to celebrate." (Surface Logic)

Rep 2: Why did you feel you had to spend $500 to celebrate?

Response: "Because everyone else was ordering expensive wine and I didn't want to be the only one drinking water." (Social Pressure)

Rep 3: Why is it important to you that you don't look like the one drinking water?

Response: "Because I’m the oldest one in the group. I should be the most successful." (Comparison/Ego)

Rep 4: Why does buying expensive wine equal 'success' to you?

Response: "Because if I can't afford it, I feel like I'm falling behind in life." (Fear of Failure)

Rep 5 (The Core): Why do you feel that your net worth determines your self-worth?

Response: "Because growing up, my dad only praised us when we achieved something visible." (The Source)

The Result: We stopped trying to "fix the budget" for the dinner. We started training the client to separate their self-esteem from their spending.

That is how you get permanent results.

No more band-aids. No more yo-yo budgeting.

When you work with me, we don't just look at the numbers. We look at the narrative. We lift the heavy weights so that your financial life becomes naturally strong, rather than artificially propped up.

Are you ready to do the heavy lifting?